Local Property Tax (LPT)

Each of the 31 Local Authorities raises revenue through Local Property Tax (LPT) in its administrative area. The allocation of this revenue is impacted by rules set by the Department of Housing, Local Government and Heritage.

Read on to learn about how LPT is allocated in each Local Authority area.

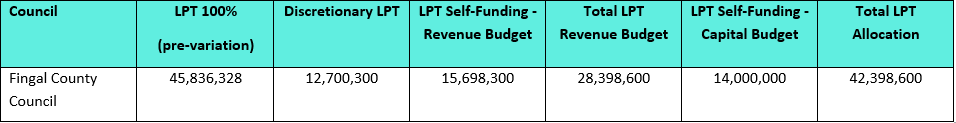

Fingal County Council – Local Property Tax 2025 – Case Study

Fingal County Council is estimated by the Revenue Commissioners to raise €45.8 million in Local Property Tax (LPT) in 2025.

- Local Authorities can vary the rate of LPT in their administrative area by +/-15% of the basic rate. Fingal County Council chose to apply a 7.5% reduction (€3.44 million) in LPT for 2025.

- The total LPT allocation for Fingal County Council post-variation (i.e. after applying the 7.5% reduction in the basic rate) is €42.4 million in 2025.

How is this spent?

The €42.4 million has to self-fund some services as directed by the Department of Housing.

- €14m has to be directed towards capital expenditure (this figure does not appear on the localauthorityfinances.com website as that only reports current expenditure).

- €15.7m goes into self-funding housing and roads

- €12.7m is for discretionary purposes

See table 1 below for detail.

Table 1 – Fingal County Council Local Property Tax allocation 2025

(Source: Local Authority Finances.com) *Note: rounding may affect totals

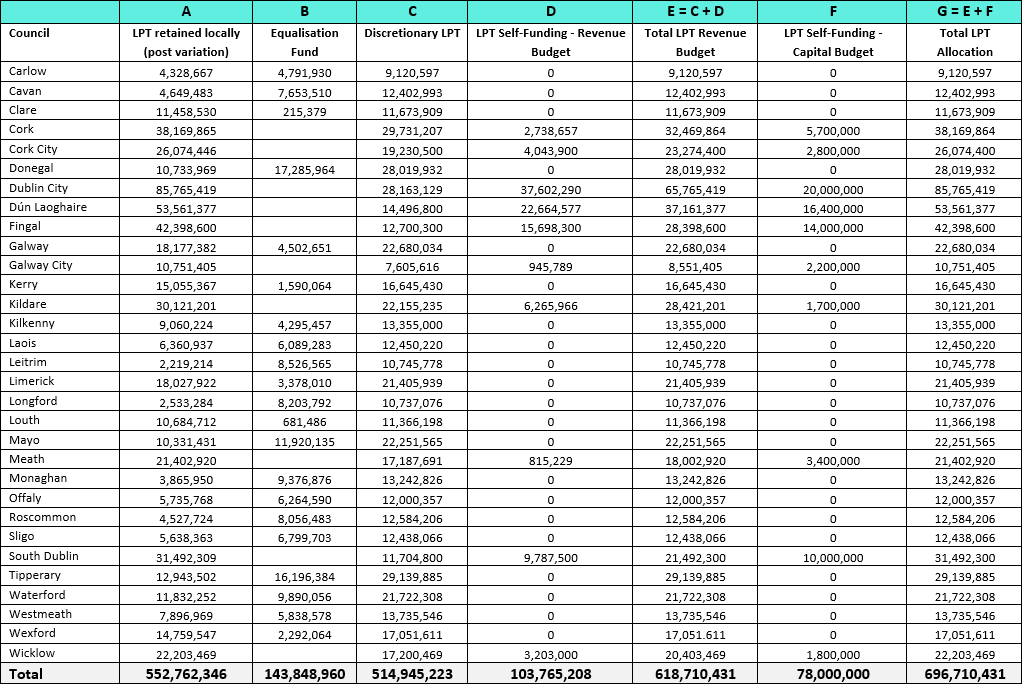

Table 2 shows the 2025 Local Property Tax allocations of the 31 Local Authorities in Ireland.

Table 2

(Source: Local Authority Finances.com)

The seven columns (A – G) break down the LPT into its various parts:

Key to Table 2